New Report on the Livelihoods of Tobacco and Former Tobacco Farmers Amidst Fierce Public Debates on Tobacco Taxes

Tobacco taxation is proven to be one of the most effective tobacco control policies. A significant increase in tobacco excise taxes typically increases tobacco prices, leading to decreases in tobacco consumption. Indonesia has recently made some advances in tobacco tax policy, while there remains significant room for improvement. The 2nd edition of the Tobacconomics Cigarette Tax Scorecard shows that Indonesia made some improvement between 2018 and 2020, including increases in cigarette prices, reduction of cigarette affordability, and an increase in the tax share of price, though some of the improvement in affordability was the result of economic decline at the beginning of the COVID-19 pandemic. The initial momentum of a good-sized excise tax increase was lost in 2021, when the Ministry of Finance reduced the increase to an average of 12.5%, which is not sufficient to stay ahead of inflation and economic growth. Importantly, there were no advances in efforts to reform the complex multi-tiered tax structure, which hinders the effectiveness of the tobacco excise tax policy, because it gives smokers many opportunities to “trade down” to cheaper products.

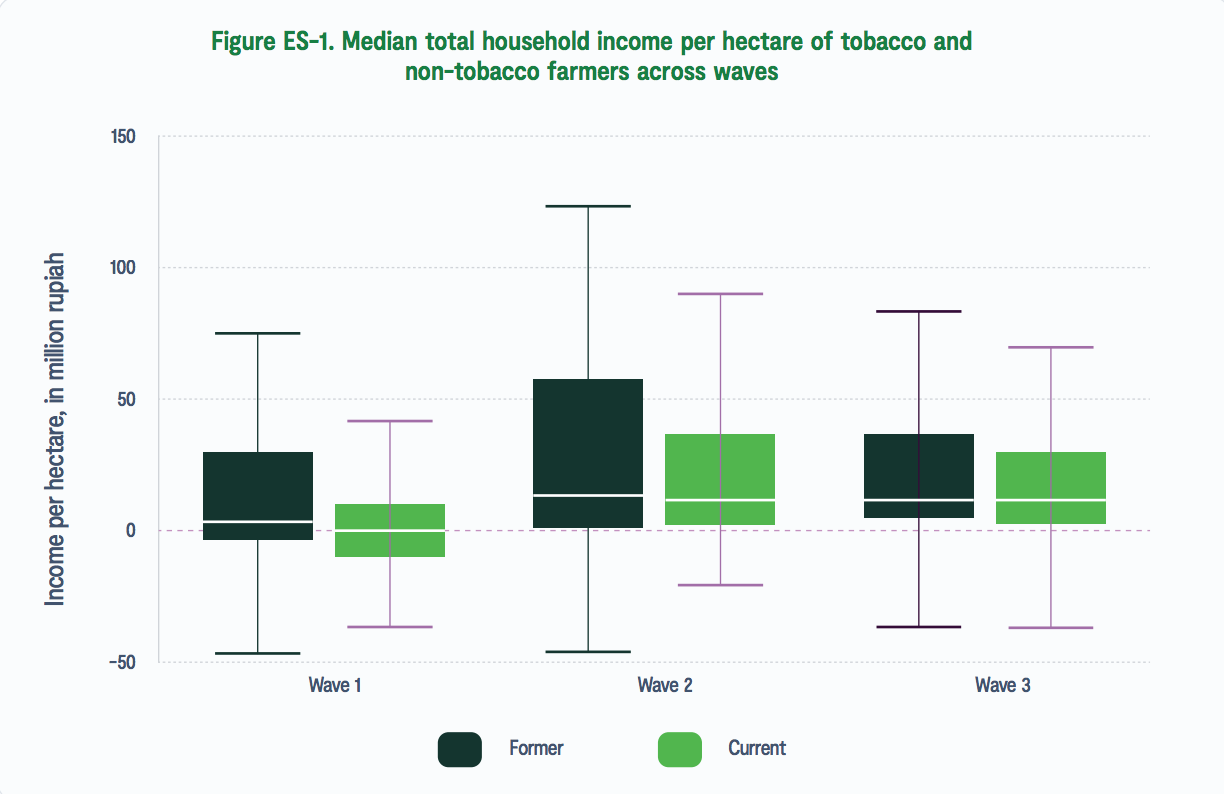

One of the persistent narratives against a progressive tobacco tax policy in the public debate—promoted vigorously by the tobacco industry— is the adverse impact taxation would allegedly have on the livelihoods of workers in the tobacco sector, particularly tobacco farmers. Yet this narrative is not backed by any rigorous research about the dynamics of tobacco farming and the alternatives to tobacco farming. In fact, results from surveys of tobacco farming households in several countries show that tobacco farming is often not a profitable endeavor. Consistent to these global findings, studies conducted in Indonesia with former and current tobacco farmers show that former tobacco farmers derived higher incomes farming non-tobacco crops in both good and challenging farming years. Former tobacco farmers were found to have a more diverse economic portfolio, while tobacco farmers relied mostly on agricultural income. A recent study shows that tobacco farming is negatively correlated with the income of farming households.

To better understand the dynamics of tobacco farming, researchers at the Universitas Gadjah Mada, the Tobacconomics team at the University of Illinois at Chicago, the Australian National University, and McGill University released the report of the third wave survey of tobacco and former tobacco farmers in Indonesia.

|

The key findings are:

|

A significant increase in tobacco excise taxes, which is claimed to lower the demand for tobacco, would encourage tobacco farmers to shift to growing non-tobacco crops and open new opportunities to pursue more economically viable and sustainable livelihoods. That said, several challenges face tobacco farmers’ ability to shift away from tobacco farming. For some farmers, tobacco is one of only a few cash crops that can grow in the harsh dry season in Indonesia.

|

Therefore, we recommend the following policy options to central and local governments:

|